These companies are ranked in accordance to their calibrated value.

Some things that impacts this calibration are

- Company purpose

- Leadership calibrations

- People working there

- Intent of the organization

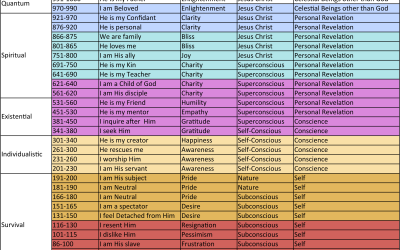

Level of Consciousness

- Tesla (253) ($TSLA) – Has made it back into top listings recently, especially noted for its market value and leadership in electric vehicles and sustainable energy.

- Apple (193) ($AAPL) – Often listed due to its massive market cap and significant influence in technology and consumer electronics.

- Eli Lilly (183) ($LLY) – A pharmaceutical giant that often makes the list due to its market capitalization and significant role in healthcare.

- NVIDIA (170) ($NVDA) – has climbed the ranks, especially with the growing importance of AI and graphics technologies.

- Amazon (159) ($AMZN) – Dominant in e-commerce and cloud services, with a substantial market share in various sectors.

- Microsoft (88) ($MSFT) – A leader in software, cloud computing, and also significant in market capitalization.

- JPMorgan Chase (70) – Frequently mentioned in terms of revenue and as a key player in financial services, although typically in discussions focusing on revenue or financial sector prominence.

- Meta Platforms (62) (formerly Facebook) ($META) – Significant in social media, advertising, and increasingly in virtual reality technologies.

- Alphabet (33) (Google) ($GOOG) – The parent company of Google, leading in search, online advertising, and increasingly in cloud computing.

- Berkshire Hathaway (23) ($BRK-B) – While not a tech company, its diverse holdings and Warren Buffett’s leadership keep it in top rankings by market cap and influence.